With the COVID-19 Pandemic, overall physical and mental health has declined as routine preventative care was pushed for over two years. While health has been top of mind, consumers are slacking on health because they’ve been stuck at home, gaining weight, living more sedentary lifestyles, and not taking care of themselves as they did pre-pandemic.

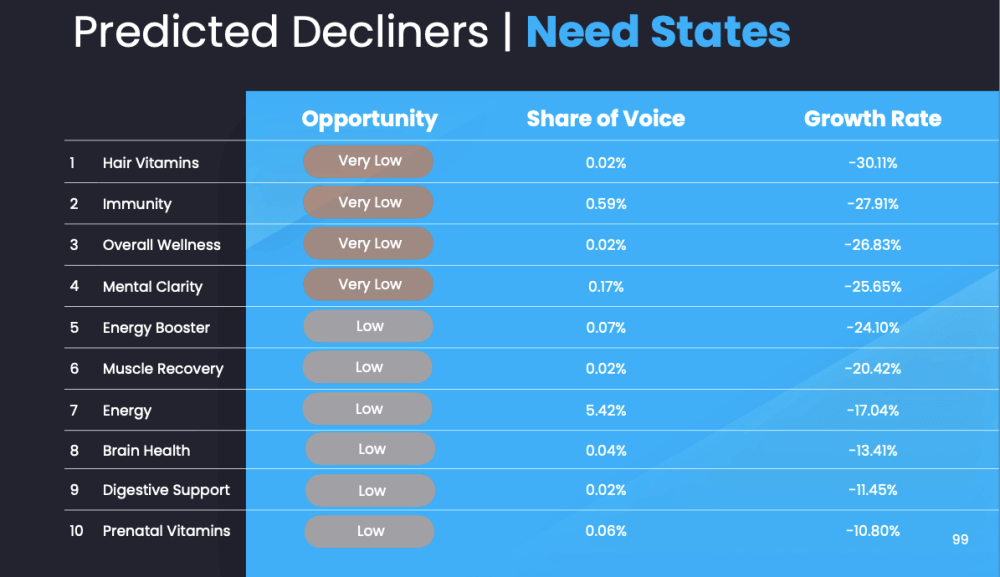

Here are our Predicted Vitamin Need State decliners for 2023

The graphic below breaks into the ten vitamin need states we predict will have the lowest potential for growth in the vitamins market in 2023. Need state opportunity scores are determined by looking at both share of voice (a leading indicator of market share) and year-over-year growth rate.

To help brands better understand the needs of their consumers, we’ve leveraged our White Space AI tool to analyze 400 vitamin market consumer need states to forecast what will be trending in 2023.

Hair Vitamins

First and foremost, Hair Vitamins (0.02 percent share of voice) have the lowest potential for growth next year. This is due to the industry’s current landscape as well as recent advancements in hair care.

While there are a few key players in the hair vitamins category, they hold a minimal share of voice relative to other categories in the supplement industry. Additionally, the year-over-year growth rate for hair vitamins is expected to decline by 30.11 percent, so products like Nutrafol’s hair growth vitamins will likely suffer in sales next year. Manufacturing vitamins relevant to your consumers is critical to remaining competitive, so stay away from Hair Vitamins if you want to continue being a leader in your category.

Immunity

Immunity vitamins and supplements peaked at the height of the COVID-19 pandemic, so our team isn’t shocked to see slowed growth (-27.91 percent) for this need state.

What is driving this predicted decline? A few key things: first, the supplement industry is seeing a bit of a slowdown. Secondly, some recent advancements in vaccines and treatments for COVID-19 have led to a decline in people searching for Immunity supplements, which explains the anticipated reduction of the need state’s 0.59 percent share of voice.

Thirdly, the ‘shelf life’ of immunity supplements is shorter than other supplement categories – meaning people are less likely to continue taking them once they feel better.

Overall Wellness

We’re not surprised to see Overall Wellness — 0.02 percent share of voice — take the third spot on our list with a projected negative growth rate of -26.83 percent. This need state is one of the most overcrowded supplement categories, with hundreds of brands (even the most significant supplement companies) vying for a piece of the pie.

Brands in the overall wellness vitamin and supplement category need to stand out to see growth. Unfortunately, with such a large number of brands, it’s become increasingly difficult to do so. Overall Wellness is too broad of a category to impact marketing campaigns and grab consumers’ attention when they pass by supplements on store shelves, so our supplement report considers this a non-option for your 2023 R&D.

Mental Clarity

Mental Clarity is the fourth supplement category on our list, with a negative 25.65 percent growth outlook for 2023. This need state (0.17 percent share of voice) has declined in popularity for the past few years, and our team doesn’t see that trend changing anytime soon.

A few possible reasons for this decline: first, several supplement categories address mental health/clarity needs (such as energy, focus, and stress), so Mental Clarity is competing with many other options. That’s why products like these Qualia Mind Mental Clarity Vitamins will struggle to sell through this coming year.

Additionally, many people are now turning to prescription drugs or psychiatric help for serious mental health concerns rather than self-medicating with supplements. Lastly, the supplement industry has been under much scrutiny in recent years, so people are increasingly skeptical of supplement claims.

Energy Booster

While RedBull might be known for its energy-boosting capabilities, an entire supplement category is devoted to giving people an extra pep in their step. Unfortunately, this supplement category (0.07 percent share of voice) is predicted to see a 24.10 percent decline in growth next year.

Like Mental Clarity, there are a number of supplement categories that address energy needs (such as caffeine, vitamins B & C, and protein). Additionally, many people are now turning to alternatives such as coffee or energy drinks.

Muscle Recovery

With a negative 20.42 percent year-over-year growth, Muscle Recovery is the fifth supplement category on our list. Currently, Muscle Recovery barely has a share of voice in the vitamins market, with a 0.02 percent share of voice.

Muscle Recovery products, even from popular brands like TB12, will likely continue to decline in popularity due to a number of factors, such as the increasing popularity of plant-based protein powders (which don’t require any recovery supplement) and the general trend of people working out at home (rather than going to the gym).

Energy

Like Energy Booster, consumers also claim to need products to help with overall Energy. While these two terms rank differently on our predicted loser’s list, they’re pretty closely related supplement categories. Energy (5.42 percent share of voice) is a broad term encompassing everything from sleep aids to vitamins. At the same time, Energy Booster is more specific to supplement ingredients that promise to give users an immediate energy boost.

As a result, the Energy category is much more crowded than Energy Booster, which could explain its lower ranking and expected negative 17.04 percent growth rate in 2023. Products like 5-hour Energy have also gotten a lot of bad press in recent years, likely leading to a decline in consumer trust.

Brain Health

Brain Health — 0.04 percent share of voice — vitamins and supplements help improve cognitive function and memory. This need state has declined for the past few years, and the team here at Simporter predicts a continuation of this trend.

Brands in the brain health niche like HVMN have been working to change the supplement industry’s reputation by conducting clinical trials and publishing their findings. However, it will likely take more time for the supplement industry to regain consumer trust. Over the next twelve months, our data suggest that Brain Health vitamins made by the largest supplement companies will perform poorly, with a -13.41 percent growth rate. Stay away from these types of supplements, and you’ll avoid making a mistake in your R&D budgeting for the next year.

Digestive Support

Digestive support takes the penultimate spot on our list with a -11.45 percent growth potential for 2023. This supplement category includes probiotics, prebiotics, and enzymes that help with digestive issues like constipation, diarrhea, and bloating. Products like Align probiotics have become increasingly popular recently, but consumer needs will shift as people settle into their post-pandemic routines. Digestive Support’s 0.02 percent share of voice will continue to shrink, so brands who rely on this small category should consider different paths towards success for the next few years.

Prenatal Vitamins

Prenatal Vitamins (0.06 percent share of voice) are taken by pregnant women or trying to become pregnant. This supplement category is predicted to see a -10.80 percent growth rate in 2023, but the big question is why. We think we have insights into the answers.

Prenatal vitamins are essential for pregnant women, but the supplement industry has been hit hard by the pandemic. Many women are delaying or avoiding pregnancy, which has led to a decline in demand for prenatal vitamins. If you’re a brand that focuses on prenatal vitamins, you will have to reposition yourself if you want to stay relevant even while there’s a downswing in expectant moms.

Conclusion

When it comes to predicted decliners, additive or nice-to-have attributes will grow much slower. Things like Hair Vitamins and Immunity Boosters that are nice — but unnecessary — won’t be as popular. For more on 2023 vitamins and supplement trends, check out our blog.

If you’re ready to see Simporter AI in action and learn what it can do for you, request a demo on our website for more insights on vitamin and supplement industry trends. Predicting need state trends is just one way Simporter can help brands grow their business, so to learn more about how we can help you, please visit us at simporter.com.