GLP-1 medications, often used to manage weight and diabetes, are creating big shifts in what people eat and drink. Appetite suppression, a key effect of these drugs, is leading to changes in consumer behavior.

To better understand these shifts, we ran a synthetic panel. Here’s what we discovered about what people are eschewing and chewing.

The Data

Synthetic Panel Results

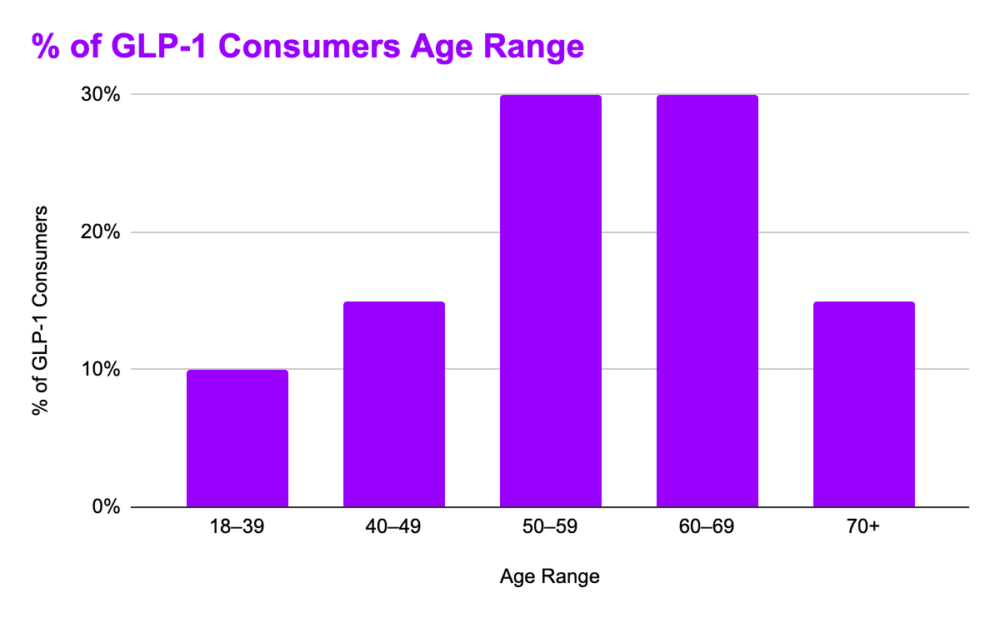

Age Distribution

| Age Range | % of GLP-1 Consumers |

|---|---|

| 18–39 | 10% |

| 40–49 | 15% |

| 50–59 | 30% |

| 60–69 | 30% |

| 70+ | 15% |

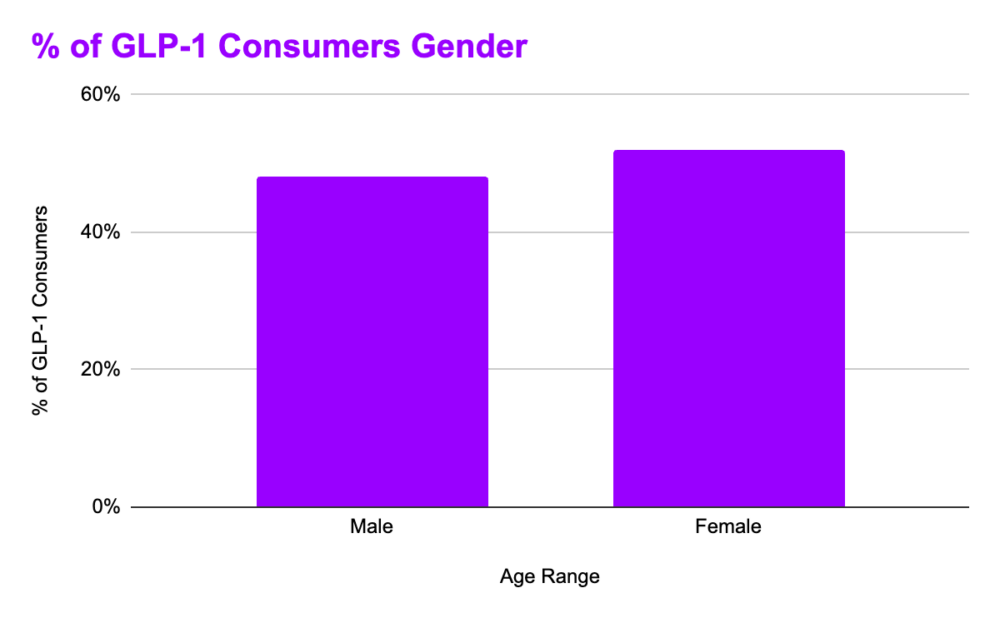

Gender Distribution

| Gender | % of GLP-1 Consumers |

|---|---|

| Male | 48% |

| Female | 52% |

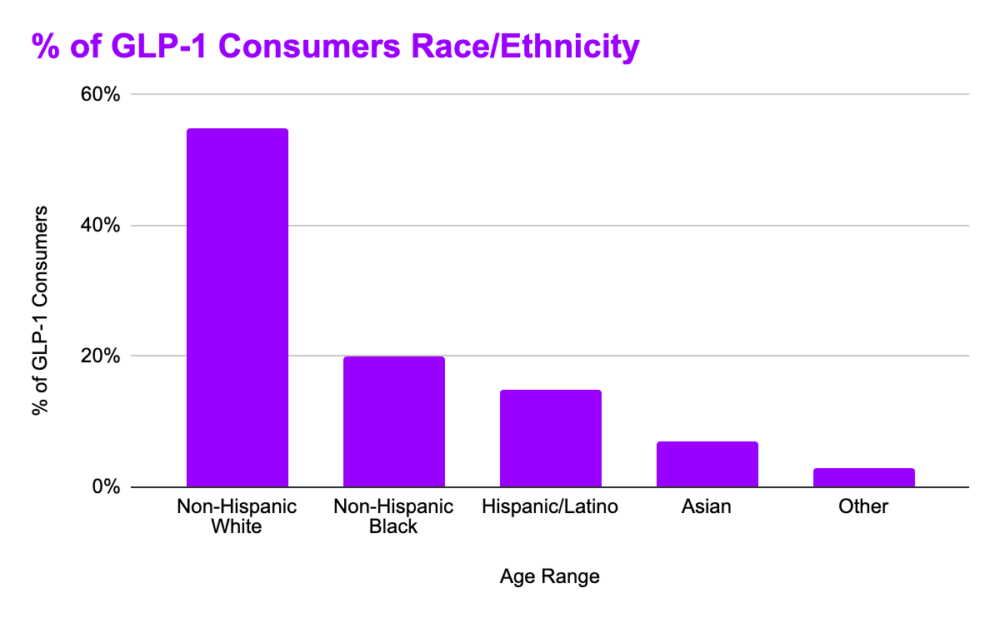

Race/Ethnicity Distribution

| Race/Ethnicity | % of GLP-1 Consumers |

|---|---|

| Non-Hispanic White | 55% |

| Non-Hispanic Black | 20% |

| Hispanic/Latino | 15% |

| Asian | 7% |

| Other | 3% |

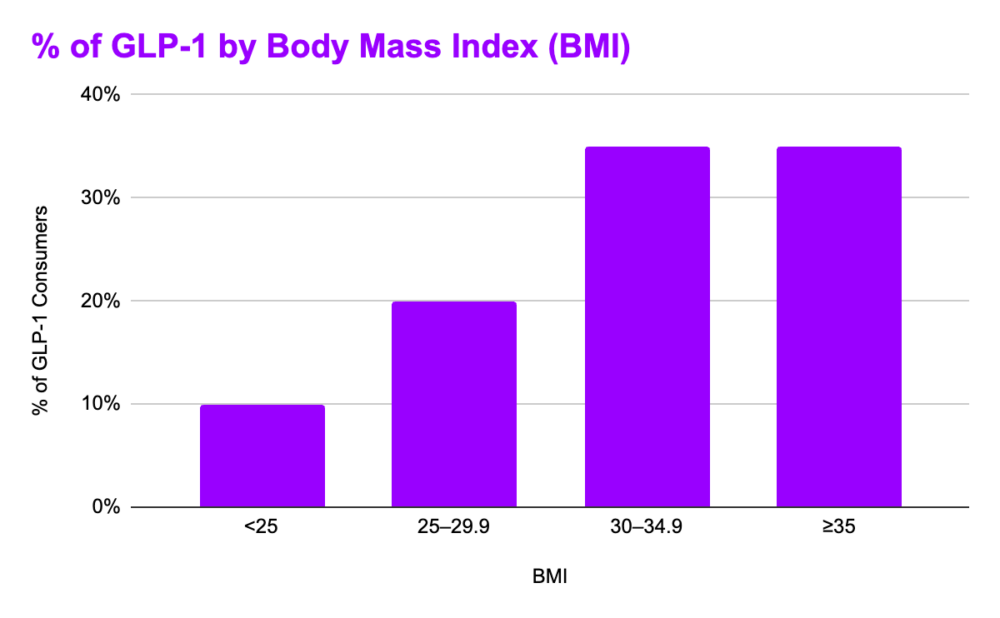

BMI Category Distribution

| BMI Category | % of GLP-1 Consumers |

|---|---|

| <25 | 10% |

| 25–29.9 | 20% |

| 30–34.9 | 35% |

| ≥35 | 35% |

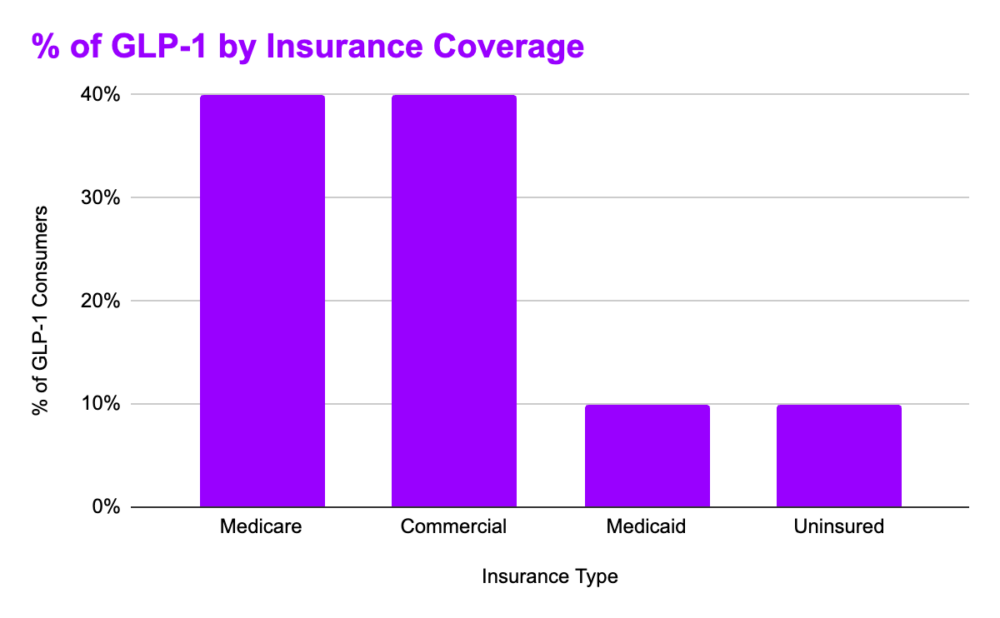

Insurance Coverage Distribution

| Insurance Coverage | % of GLP-1 Consumers |

|---|---|

| Medicare | 40% |

| Commercial | 40% |

| Medicaid | 10% |

| Uninsured | 10% |

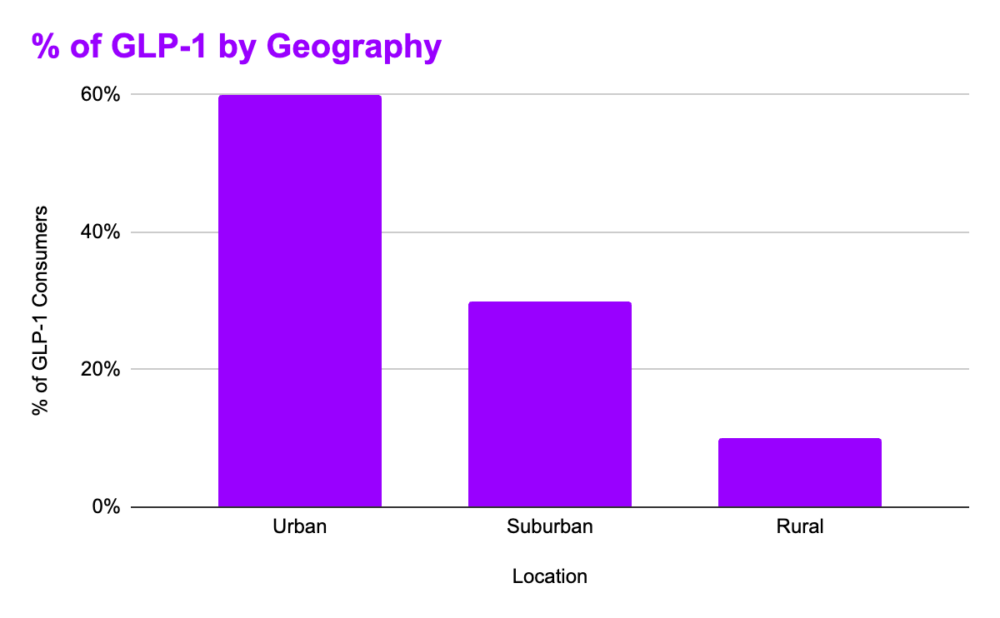

Geographic Location Distribution

| Geographic Location | % of GLP-1 Consumers |

|---|---|

| Urban | 60% |

| Suburban | 30% |

| Rural | 10% |

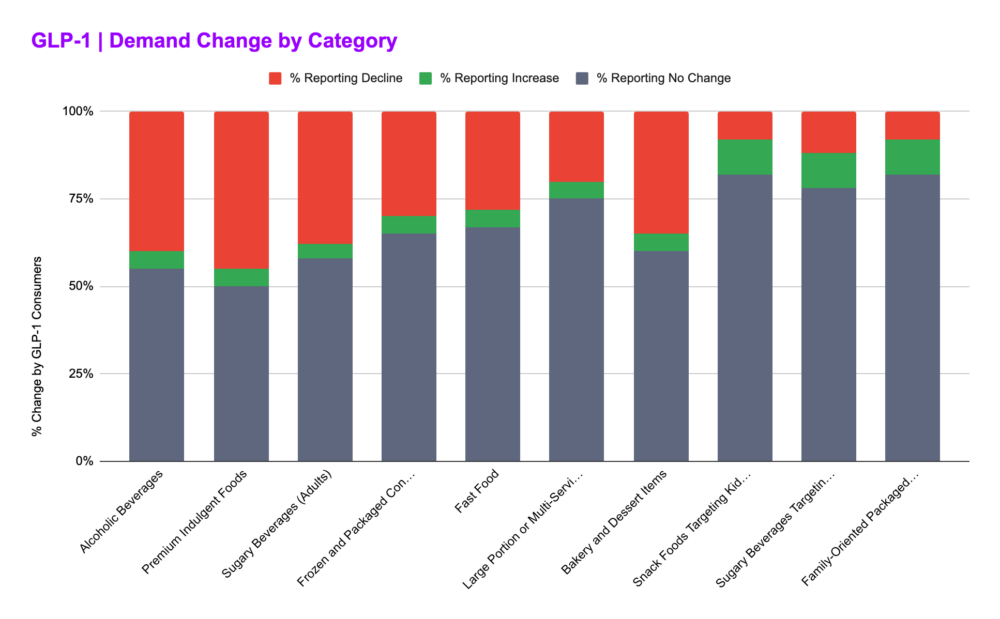

Changes in Consumer Purchasing Behavior

Percentages represent the portion of consumers reporting each type of change.

| Category | % Reporting Decline | % Reporting No Change | % Reporting Increase |

| Alcoholic Beverages | 40% | 55% | 5% |

| Premium Indulgent Foods | 45% | 50% | 5% |

| Sugary Beverages (Adults) | 38% | 58% | 4% |

| Frozen and Packaged Convenience Foods | 30% | 65% | 5% |

| Fast Food | 28% | 67% | 5% |

| Large Portion or Multi-Serving Packs | 20% | 75% | 5% |

| Bakery and Dessert Items | 35% | 60% | 5% |

| Snack Foods Targeting Kids/Teens | 8% | 82% | 10% |

| Sugary Beverages Targeting Kids | 12% | 78% | 10% |

| Family-Oriented Packaged Foods | 8% | 82% | 10% |

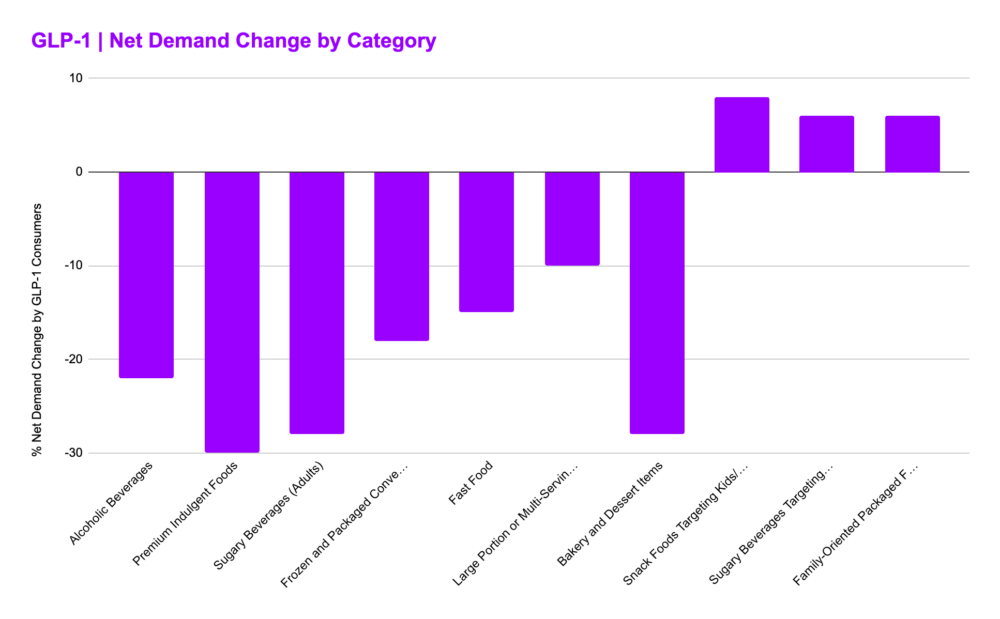

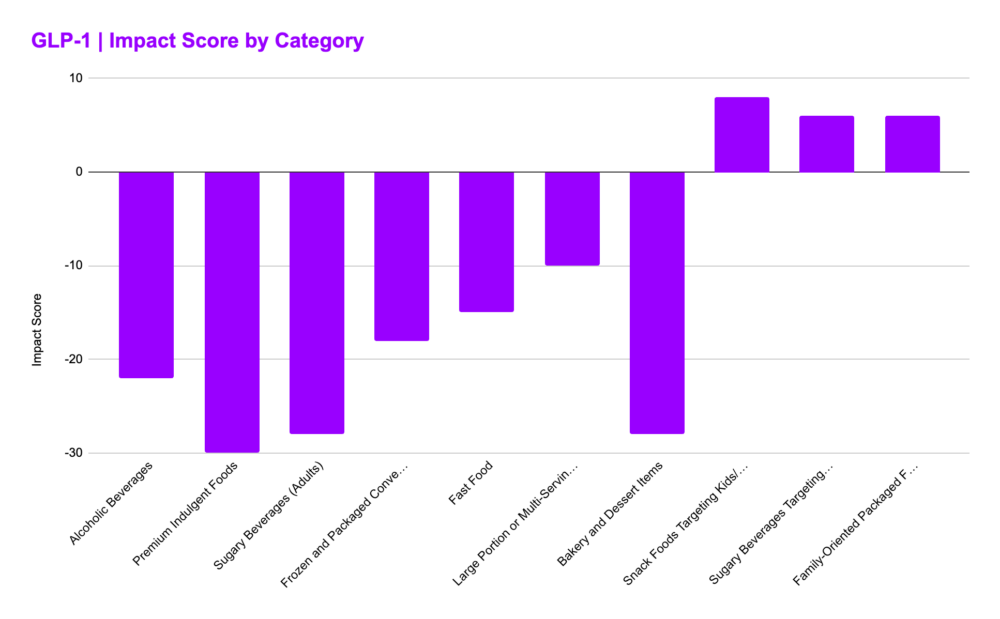

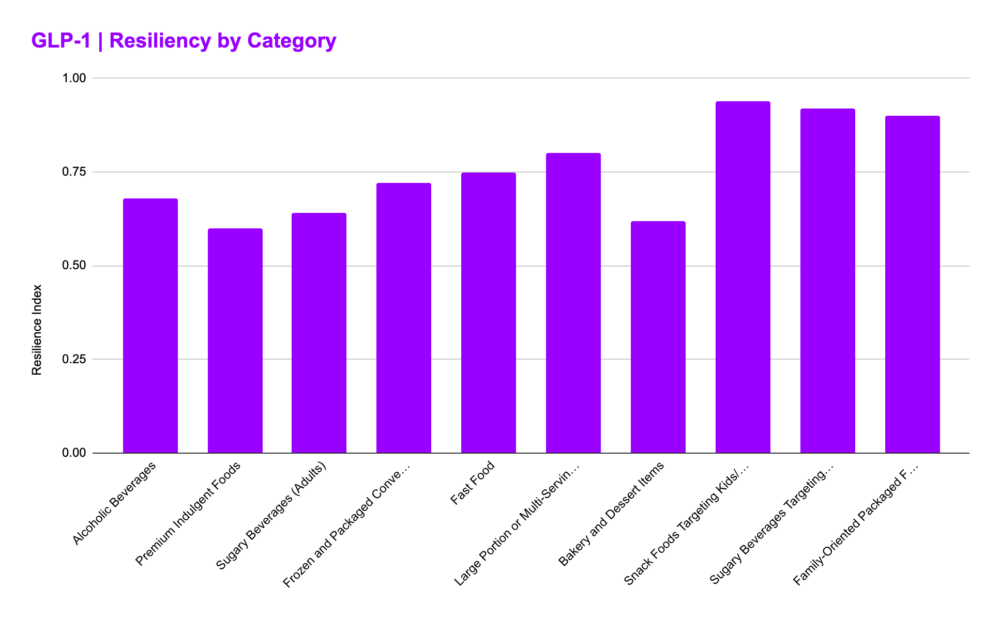

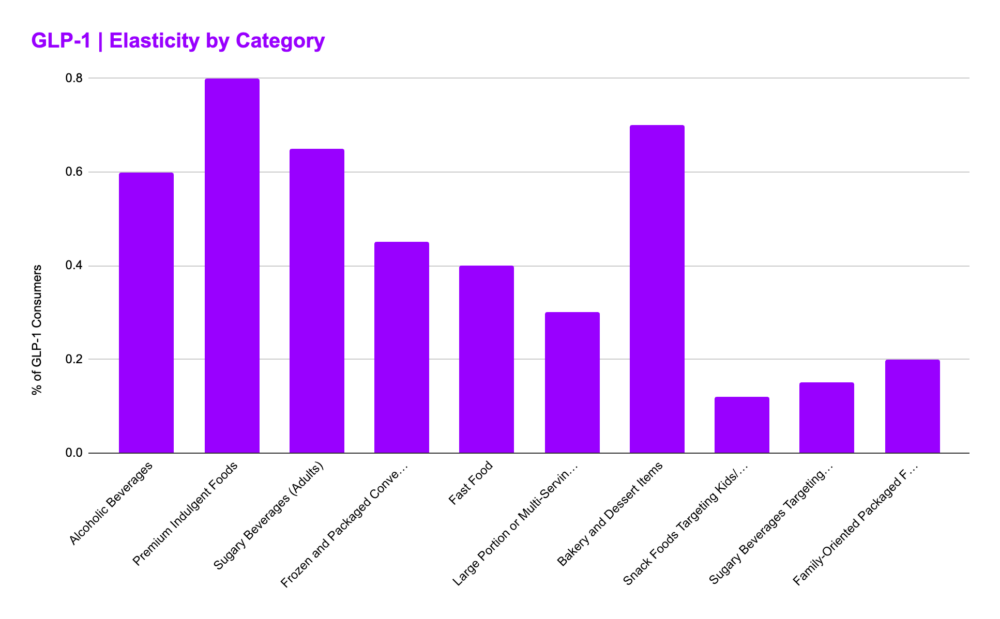

Market Impact and Demand Elasticity Indicators

Negative values indicate declining demand, positive values indicate increasing demand.

| Category | Impact Score | Elasticity | Resilience Index | Net Demand Change (%) |

| Alcoholic Beverages | -22 | 0.6 | 0.68 | -22 |

| Premium Indulgent Foods | -30 | 0.8 | 0.6 | -30 |

| Sugary Beverages (Adults) | -28 | 0.65 | 0.64 | -28 |

| Frozen and Packaged Convenience Foods | -18 | 0.45 | 0.72 | -18 |

| Fast Food | -15 | 0.4 | 0.75 | -15 |

| Large Portion or Multi-Serving Packs | -10 | 0.3 | 0.8 | -10 |

| Bakery and Dessert Items | -28 | 0.7 | 0.62 | -28 |

| Snack Foods Targeting Kids/Teens | 8 | 0.12 | 0.94 | 8 |

| Sugary Beverages Targeting Kids | 6 | 0.15 | 0.92 | 6 |

| Family-Oriented Packaged Foods | 6 | 0.2 | 0.9 | 6 |

What Is a Synthetic Panel?

A synthetic panel is a research tool used to predict how groups behave over time. It combines real data from surveys with statistical modeling to fill in gaps. This method is especially helpful when studying trends in groups where long-term data isn’t available. For this study, the synthetic panel helped us examine how GLP-1 use affects choices in food and drink categories.

How GLP-1 Impacts Consumer Behavior

Appetite suppression changes how people approach eating and drinking. People using GLP-1 often feel less hungry, which leads to fewer cravings. These changes ripple through many food and drink categories, especially those tied to indulgence or convenience.

30 Insights on GLP-1

GLP-1 Insight 1

Many people using GLP-1 medications are between 50 and 69 years old, which suggests that these treatments are common in middle-aged adults. This could be because health issues like type 2 diabetes often appear at these ages.

In addition, slightly more women are taking these medications than men, which might show differences in health choices. People with higher BMIs tend to be frequent users, showing the link between weight issues and these drugs. Urban and suburban settings have more GLP-1 users, possibly due to better access to doctors and pharmacies.

GLP-1 Insight 2

Medicare and commercial insurance plans cover many people who use GLP-1 medications. This means that older adults and working individuals are likely to get these treatments.

At the same time, uninsured groups have less access, which could make it harder for them to manage chronic health problems. This may increase health differences among different communities. Insurance coverage plays a big part in who can afford these newer treatments.

GLP-1 Insight 3

When it comes to food and drink choices, many adults seem to be cutting back on sugary beverages. Almost 38 percent report drinking fewer sugary beverages, and only a small percentage say they drink more.

This change could help reduce health risks tied to weight gain and diabetes. It also shows that people might be becoming more aware of what they drink. If this trend continues, it could affect how companies produce and market these drinks.

GLP-1 Insight 4

Many shoppers have not changed how often they buy premium indulgent foods. Still, around 45 percent say they are buying less.

This might be because people want to eat healthier and save money. Premium foods can be more expensive and less healthy. Over time, this might push companies to make healthier and less costly treats.

GLP-1 Insight 5

Fast food buying seems mostly stable with most people not changing their habits. About 28 percent say they buy less, but the majority see no difference.

This suggests that fast food still has a strong hold on many diets. Still, any shift toward less fast food might lead to better health. Even a small change could have a positive effect on weight and overall wellness.

GLP-1 Insight 6

Family-oriented packaged foods have mostly stayed the same in shopping carts. Around 82 percent see no change in their buying.

Yet a small portion reports an increase, which might mean that busy families still rely on these for convenience. If these foods become healthier, it could help improve family diets. More balanced options could also keep these products popular.

GLP-1 Insight 7

Snack foods targeting kids and teens show a mix of change. Some families are buying less, but others are buying more.

This could mean different groups have different opinions on snacking. Kids might ask for them, while parents might worry about sugar and health. Companies may need to find ways to offer snacks that are both tasty and better for health.

GLP-1 Insight 8

Bakery and dessert items are bought less often by a large group of people. About 35 percent say they are buying fewer sweets.

This could mean that people are watching their sugar intake or their spending. If this trend continues, companies may need to find ways to make desserts healthier. Better ingredients and smaller portions might help keep customers interested.

GLP-1 Insight 9

Some shoppers are choosing fewer large portion or multi-serving packs. Only about 20 percent report a decline, but most say no change.

Those who buy less might be thinking about waste, cost, or health. Smaller packages might fit changing family sizes or diets. If companies adjust package sizes, they could meet these new customer needs.

GLP-1 Insight 10

The impact scores for certain products like alcoholic beverages and sugary drinks show a drop in demand. Negative impact scores mean fewer people want these items.

This might show that health concerns and price worries matter. Over time, these drops might reshape what is sold in stores. Companies might need to rethink recipes, prices, or packaging to keep customers.

GLP-1 Insight 11

Elasticity measures how people react when prices change. For drinks and snacks with higher elasticity, shoppers will buy less if prices go up.

If companies raise prices too much, people might just stop buying these products. This could mean lower profits for the companies. Keeping prices steady or improving product value might help keep sales stable.

GLP-1 Insight 12

Resilience indexes show how well a product can handle changes in demand. Products with high resilience can keep selling even if buyers become more careful.

For example, family-oriented packaged foods still have strong resilience. This suggests that certain staples remain popular even during tough times. By focusing on these strong products, companies can stay successful.

GLP-1 Insight 13

Net demand change shows if a product is growing or shrinking in popularity. Positive numbers mean more interest, while negative numbers mean people are moving away.

Snack foods for kids and teens have a slight increase, which might reflect playful branding or fun flavors. Family foods also have a small positive change, showing steady demand. Companies that handle these categories well can keep growing their sales.

GLP-1 Insight 14

When people reduce their buying of certain foods, it might connect to what doctors recommend. For instance, those taking GLP-1 medications might also watch their sugar intake.

They could be cutting back on bakery items, sugary drinks, and large portion packs. This might help them control their weight and diabetes. If food makers respond, they can support healthier choices.

GLP-1 Insight 15

As more people become aware of health issues, they may seek foods that fit better with their wellness goals. The small shifts in buying habits for many foods reflect changing ideas about health and happiness.

People might be willing to pay more for healthier options if they trust the products. Over time, these trends could reshape the entire food and drink market. By making better foods, companies can earn loyal customers who care about health.

GLP-1 Insight 16

Some people who use GLP 1 medications might also avoid buying large packaged foods. This may help them control how much they eat and stick to doctor recommendations.

When fewer people buy these big packs, stores might sell more smaller packs. This could lead to less food waste and better portion sizes. It may also support families trying to eat healthier.

GLP-1 Insight 17

As more shoppers choose not to buy sugary drinks, companies might try making drinks with less sugar. People want to enjoy a sweet taste but also protect their health.

If these healthier drinks sell well, other companies might follow. This could make it easier for everyone to find better drink options. In time, sugary drinks might no longer be as common.

GLP-1 Insight 18

When fewer people buy bakery and dessert items, it can affect bakeries and sweet shops. They might have to lower prices or offer healthier treats.

If they do, customers might return to buy these items. This can create a balance between taste and health. Everyone can benefit if food makers listen to what people want.

GLP-1 Insight 19

The fact that snack foods for kids and teens still have some growth might mean that fun flavors and bright packaging are working. Children often ask for treats they see in ads or at the store.

Parents might give in sometimes, but they also want better nutrition. If companies add more whole grains and less sugar, parents might feel happier about these snacks. Better choices help both kids and parents.

GLP-1 Insight 20

Fast food remains popular, even though some people say they buy less. It is quick, cheap, and easy.

If restaurants make small changes like adding more fruits and veggies, more people might choose them. This could help families on busy nights. Healthier fast food could mean better habits over time.

GLP-1 Insight 21

Family oriented packaged foods hold strong even as other categories change. These items fit well into many households because they are easy to prepare and often taste good.

If companies add better ingredients, they can remain trusted brands. Families who value time and health may keep buying these products. A small shift in recipes could mean big health gains.

GLP-1 Insight 22

Alcoholic beverages show a drop in demand, which might mean people are more careful about drinking. This could come from health advice or cost concerns.

If fewer people drink alcohol, stores might stock more non alcoholic drinks. More choices can help people enjoy a drink with friends in a healthier way. Everyone wins when there are good options for all tastes.

GLP-1 Insight 23

The elasticity numbers show that when prices go up, many people reduce their buying. Companies need to watch their prices closely.

If they go too high, customers might switch to cheaper brands or stop buying.

Keeping costs fair can keep customers happy. It also builds long term trust and loyalty.

GLP-1 Insight 24

Resilience means that even when times are tough, some products still sell well. Family oriented foods and kid snacks seem to have strong resilience.

This might mean people will always need these basic items no matter what. If companies use this chance to make them healthier, they can do well in the long run. Good nutrition plus steady demand makes a winning formula.

GLP-1 Insight 25

Net demand change shows us if people are moving away or toward a product. For many items, the change is negative, meaning people are drifting away.

This might make companies worried, but it can also push them to improve their products. Healthier ingredients, lower prices, or more eco friendly packaging can help. Customers might return if changes meet their needs.

GLP-1 Insight 26

As GLP 1 medications become more common, food shopping patterns might keep changing. People who need these medications might also follow doctor advice about diet.

If these patients eat less sugar and fat, it can change the whole market. Over time, food producers can adjust and offer better items. This helps everyone live healthier lives.

GLP-1 Insight 27

Changes in behavior can also affect how new products are tested. If people are drinking less sugary soda, companies might try new flavors or sugar free options.

This lets them see what people really want. Adjusting to meet changing tastes is key. It keeps them strong even when old favorites fade.

GLP-1 Insight 28

The world of packaged foods is always changing. Some people want healthier snacks while others still want treats.

If a company can find a balance, it can keep both groups happy.

Over time, that might mean a new normal of smarter choices. This could lead to better health across the board.

GLP-1 Insight 29

As we see more people taking GLP 1 drugs, there may be more interest in better labeling. Easy to read labels can help shoppers pick products that fit their needs.

If companies are clear and honest about ingredients, customers trust them more. This can lead to repeat buyers and good word of mouth. Everyone wins when information is easy to understand.

GLP-1 Insight 30

All these changes show how health awareness can shape a market. When people learn about nutrition, they often make better choices.

If products become healthier, everyone benefits.

Companies can stay in business and people can improve their diets. This cycle can lead to a healthier world.