In recent years, the business landscape has seen a meteoric rise of Direct-To-Consumer (DTC) startups. These agile companies have bypassed traditional retail channels, offering consumers a more personalized and streamlined shopping experience. While they may not have the historical presence of Consumer Packaged Goods (CPG) giants like Procter & Gamble (P&G), what they lack in legacy, they make up for in innovation and nimbleness.

The challenge these startups pose to CPG stalwarts is far from trivial. With a focus on niche markets, customer-centric experiences, and rapid product development, DTC companies are forcing traditional giants to rethink their well-established business models. Now, the spotlight turns to data analytics—a field that could very well determine the victor in this corporate battlefield.

Can data analytics provide the arsenal needed to win this struggle? The answer is an emphatic yes. In an era where every click, share, and ‘like’ counts, data analytics tools, like Simporter, can offer a lens into consumer sentiment and emerging market trends. This enables both old and new players to not just survive but thrive. So, as we delve deeper, prepare to discover how predictive analytics could become the great equalizer in this fascinating tug-of-war between established CPG titans and rising DTC stars.

P&G: The Established Titan

As we set the stage for understanding this intriguing dynamic between DTC startups and traditional giants, let’s first look at Procter & Gamble (P&G), the epitome of an established CPG titan. With a portfolio that encompasses everything from household cleaning products to personal care items, P&G’s brand lineup reads like a “Who’s Who” of consumer staples. For decades, its products have sat on the shelves of nearly every American household, building a longstanding relationship with consumers that startups would envy. This consumer trust has been nurtured over many years and is one of P&G’s most valuable assets.

However, even Titans aren’t immune to challenges. For P&G, two key issues loom large: market saturation and shifting consumer preferences. In many of its core markets, growth is stalling as the shelves become crowded with both legacy brands and disruptive newcomers. Even more pressing is the seismic shift in consumer behavior. The new-age consumer, empowered by technology and spoiled for choice, is increasingly favoring niche, eco-friendly, or customized products—areas where P&G’s broad-strokes approach falls short.

So, where does data analytics fit into this evolving landscape for P&G? Historically, the company relied on traditional market research methods—focus groups, surveys, and the like—to glean consumer insights. However, the data landscape is undergoing a transformation. Now, P&G is racing to modernize its approach, employing sophisticated analytics tools to make sense of consumer behaviors, preferences, and trends in real time. This shift towards more agile data strategies marks a pivotal moment for the company, offering a glimmer of hope that it can adapt and compete in this new era.

The role of data in shaping P&G’s future cannot be understated. With startups like Harry’s gaining traction by the day, P&G’s approach to data analytics could well be the key to holding its ground. As we transition into the world of these younger, data-driven companies, let’s examine how one such DTC startup is making waves in an industry long dominated by P&G.

Harry’s: The DTC Maverick

Founded in 2013, Harry’s radically disrupted an industry that had long been dictated by just a few big names. By cutting out the middleman and selling high-quality razors directly to consumers, Harry’s turned the traditional business model on its head. The startup’s approach resonated with millennials and Gen Z, who were on the lookout for quality, affordability, and convenience—all neatly wrapped in a modern brand aesthetic.

But success in the startup world is seldom straightforward. To grow beyond its initial razor-focused niche, Harry’s tackled scaling and expansion with grit and finesse. It diversified its product offerings, adding skincare and grooming essentials like face wash and shaving gel to its lineup. The brand also expanded geographically, tapping into international markets. All of this while maintaining its core ethos of consumer-first thinking, thereby successfully broadening both its product range and customer base.

The linchpin of Harry’s success, however, has been its agile use of data analytics. Unlike traditional companies that may take months to act on consumer insights, Harry’s makes real-time adjustments to everything from product formulation to marketing strategies. Through meticulous data collection across eCommerce platforms and social media, the company is able to personalize customer experiences, forecast demand, and even adjust pricing and promotional strategies on the fly. In short, Harry’s has its finger on the pulse of consumer behavior, ensuring that it stays ahead in this fast-paced industry.

So, while P&G has had to recalibrate its strategies to keep up with changing times, Harry’s has been writing its own playbook from the get-go, setting the stage for a fascinating case study in contrasts.

P&G vs. Harry’s: A Case Study

After understanding the individual strategies of P&G and Harry’s, it’s only natural to ask, how do these contrasting approaches stack up when they go head-to-head? Let’s focus on the men’s grooming sector, a battleground where both companies compete fiercely yet distinctively. P&G, with its Gillette brand, has been a household name for decades, symbolizing quality and trust. Harry’s, on the other hand, entered this market offering a similar quality but with an emphasis on direct-to-consumer convenience and affordability. Both aim to win the same customer but through divergent strategies.

When it comes to data analytics in competition, the differences become even more striking. P&G, with its time-tested methods, tends to use data for long-term planning and quarterly reviews. While this offers stability, it’s often less agile than desired. Harry’s, conversely, uses data as a dynamic tool, constantly tweaking products and marketing strategies based on real-time consumer feedback. Even though both companies operate in the same niches, their data strategies are as different as night and day, offering a fascinating lens through which to explore how old and new business paradigms intersect.

Now let’s talk about something that truly keeps businesses up at night: customer experience and loyalty. P&G has relied on generational trust, a formidable asset but one that’s increasingly hard to bank on as new generations seek brands that align with their values and lifestyles. Harry’s, meanwhile, uses data to optimize customer touchpoints, personalize interactions, and develop products rapidly based on consumer demands. These data-driven strategies offer Harry’s a better opportunity to build loyalty among younger audiences, who crave tailored experiences and rapid innovation.

So, while P&G leans on its long-established reputation, Harry’s is banking on agility and customer-centricity, powered by intelligent data use.

Data’s Predictive Power: The Crystal Ball

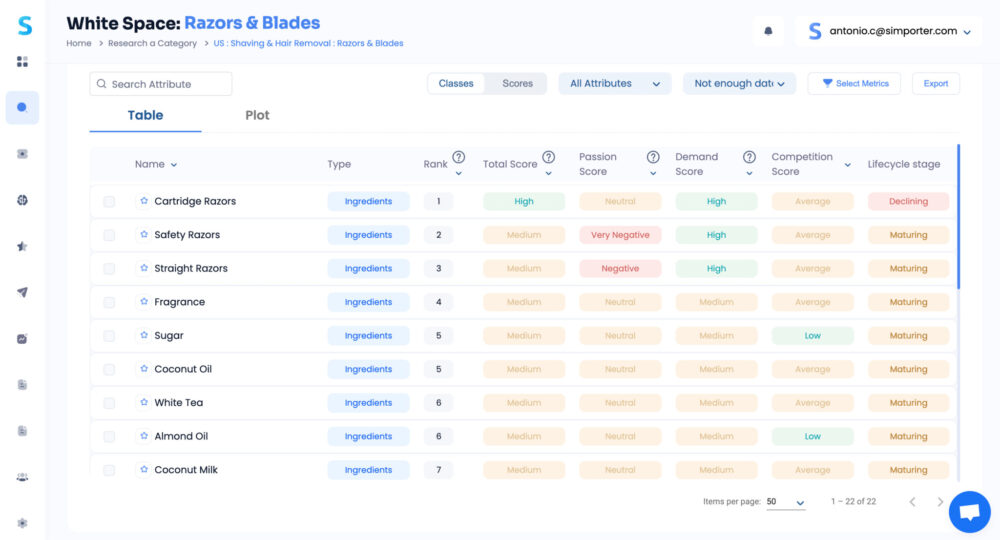

So we’ve seen how P&G and Harry’s implement contrasting strategies in the market. But the crux of the matter lies in leveraging predictive analytics to tap into consumer sentiment and market trends effectively. Take Simporter, for example. Its capabilities to sift through Instagram mentions, gauge ‘passion metrics,’ and scrutinize eCommerce reviews give both old-school giants and new-age disruptors a leg up. Imagine being able to not just see what consumers are talking about today but predict what they will crave tomorrow. That’s actionable intelligence, a real asset in today’s dynamic market.

Now, no business endeavor is without risk, but risk mitigation is where analytics really shine. Let’s say P&G is planning to launch a new line of eco-friendly grooming products. Traditional market research methods might offer some insights, but they can’t match the predictive prowess of a tool like Simporter. By forecasting sales and even incremental sales, the tool allows both P&G and Harry’s to evaluate the financial implications before even rolling out a single product. It’s like having a financial crystal ball, guiding you through the labyrinth of market uncertainties.

Innovation and adaptation are not mere buzzwords; they are essential business imperatives. Here, predictive analytics can be the secret sauce for making informed decisions on product development and strategy overhaul. Simporter takes it up a notch by not only providing data but also generating high-performing product concepts based on that data. Imagine, being able to test a new product idea before it even goes into production—all within the same tool. This is data analytics transcending into the realm of practical execution, helping companies like P&G and Harry’s to prioritize top-performing concepts for market introduction.

So, whether you’re a seasoned player like P&G or a fast-moving disruptor like Harry’s, the key to victory in today’s market lies in embracing the predictive capabilities of data analytics. It’s not just about competition; it’s about evolving with the consumer and the times.

Conclusion

In a world where Direct-To-Consumer startups like Harry’s are rattling the cages of established CPG titans such as Procter & Gamble, the one common denominator driving success for both is data analytics. Each uses it differently—P&G leans on its rich legacy and expansive portfolio, while Harry’s exemplifies agility and hyper-targeted marketing. Yet, both have something to learn from the other. And that’s where the transformative power of predictive analytics, epitomized by platforms like Simporter, comes into play.

From sussing out consumer sentiment to mitigating financial risks and fostering innovation, data is the linchpin that can either make or break a brand in today’s hyper-competitive market. For companies, regardless of their market tenure, adapting to this data-centric model isn’t just an option; it’s a necessity for survival and growth in an ever-evolving consumer landscape.