As we reviewed in our recent blog about Predicted Winners for Oral Care categories in 2023, the oral care industry is rapidly changing after decades of minimal innovation. However, this doesn’t mean that all categories are seeing growth – in fact, quite the opposite. We took a look at 45 different oral care categories to analyze their growth rates (in this case, negative growth rates) and share of voice.

To better understand which categories of oral care products are the least popular with consumers for the rest of 2023, we dug into the data. Using our White Space AI tool, we’re here to help you determine which oral care products to add to or keep in your lineup. You’ll find our predictions for losing oral care categories for 2023 below.

Tooth Powder

First on the list is Tooth Powder. This category is expected to see a significant decline in growth, with a decrease of 46.37 percent by 2023. It’s currently only at a 0.14 percent share of voice, so it’s not likely to impact the industry as a whole.

Tooth Powder is used as an alternative to toothpaste and is often seen as more natural. However, with a lack of awareness and heavy competition from other forms of oral care, it’s not likely to make waves in the coming years. Products such as Burt’s Bees Tooth Powder may need to consider a rebrand to continue capturing the interest of consumers.

Tongue Cleaners

Tongue cleaners are exactly what they sound like – a tool used to clean the tongue. They come in various shapes and sizes, but all do the same job. Second on our list, this category is expected to see a fairly steep decrease in growth by 2023, with an expected negative growth rate of 32.02 percent.

At the moment, tongue cleaners like this one from DenTek hold a 0.22 percent share of voice, but with such a low projected growth rate, this is likely to change in the next few quarters. Tongue cleaners are often touted as a more effective way to clean the mouth than traditional brushing, but they have yet to catch on with the majority of oral care consumers.

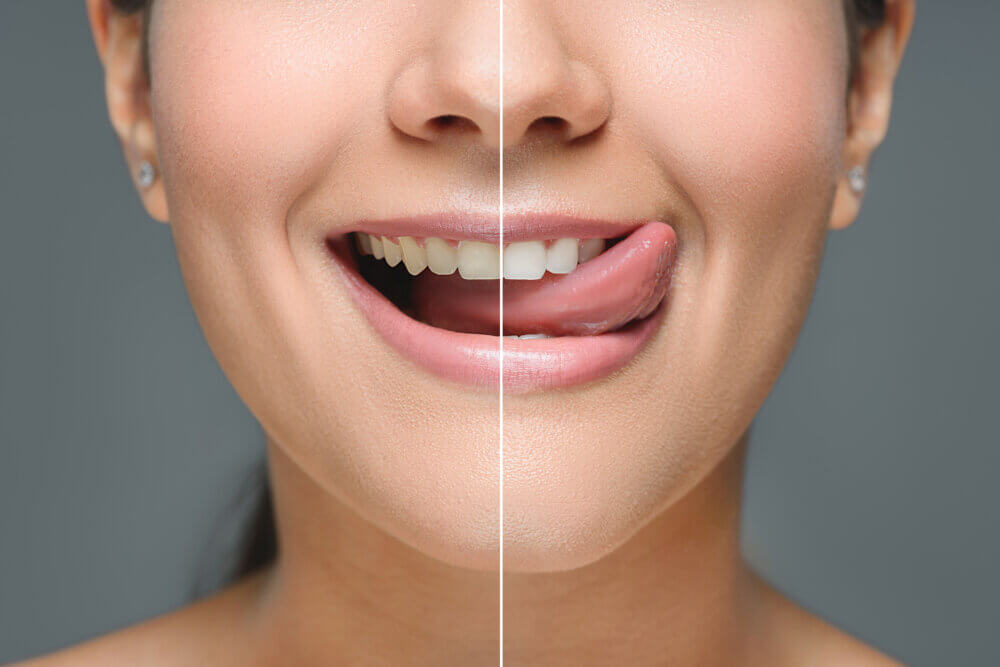

Whitening Gels

If you’re looking for a category that’s expected to see a decrease in growth and share of voice by 2023, look no further than Whitening Gels. This category is predicted to have a negative growth rate of 19.37 percent and currently holds a 0.28 percent share of voice.

Whitening gels are a popular way to achieve brighter teeth, but they often require too much time and effort. With so many other whitening options on the market, such as whitening strips and toothpaste, it’s not likely that this category will make a big splash in the coming years. Smile Brilliant’s Whitening Gel is an excellent example of a product in this category that should consider putting more resources towards other whitening product lines instead.

Toothpaste

Every household needs toothpaste, and this category is still one of the Oral Care industry’s leaders. However, it is predicted to see a decrease in growth by 2023, with a negative growth rate of 17.89 percent. But why?

Toothpaste (7.98 percent, the largest on this list) is a staple in the oral care market and has been for many years. However, with a saturated market and an increasing number of consumers looking for more natural products, toothpaste may start to lose its appeal. Brands such as Colgate and Crest will need to continue innovating their products to stay ahead of the curve.

Mouthwash

Mouthwash is behind Toothpaste on our list, with a negative growth rate of 15.74 percent throughout 2023. It currently has a 1.69 percent share of voice and is expected to continue losing steam in the next few years.

Mouthwash is often seen as a more effective way to clean the mouth than traditional brushing, but it has yet to catch on with the majority of oral care industry consumers. Brands such as Oral-B and Listerine are two examples of companies that make mouthwash and may want to consider alternatives to their tried and true oral hygiene products.

Whitening Strips

We’ve already discussed Whitening Gel, but what about Whitening Strips? They are expected to have a negative growth rate of 15.48 percent by 2023 and currently hold a 0.42 percent share of voice.

The difference between Whitening Strips and Whitening Gels is that Whitening Strips are more affordable and easier to use, making them a popular choice for people who want brighter teeth without a lot of hassle. Crest is one brand that is well known for Whitening Strips, and they are a great example of a company that will continue to invest in this category despite the slight downturn in popularity that we expect to see this year.

Denture Adhesive

With only 0.10 percent of the market share and a growth rate of -8.84 percent, Denture Adhesive is yet another oral care category expected to see a decline in popularity in the next few years. This product is often used by people who wear dentures and is designed to keep them in place for more extended periods. However, with the increasing popularity of dental implants and other methods of denture replacement, this category is likely to see a decrease in sales.

Want more blog content like this? Check out our feed to see what other data trends and insights we’ve been covering lately.

Tongue Scrapers

Last on our list is Tongue Scrapers. Tongue Scrapers like this from TOKI are one of the Oral Care industry’s most minor categories, with only a 0.09 percent share of voice. However, they are still expected to see a decrease in popularity throughout 2023, with a negative growth rate of 2.64 percent.

Tongue scrapers are designed to remove bacteria and food debris from the tongue’s surface and are a popular choice for people who want to keep their mouths healthy. However, with the increasing popularity of oral probiotics and other natural oral care methods, tongue scrapers may start to lose their appeal.

Stay Away From These Losing Categories

Now that we’ve gone over the Oral Care industry categories that are expected to see a decline in popularity by 2023, you should have a better understanding of where consumers are planning to spend their money for the rest of the year. If your brand needs more insights like these to stay ahead of the competition, check out our blog for more data-driven content.

For more insights on Oral Care industry trends, check out our recent webinar. If you’re ready to see Simporter AI in action and learn what it can do for you, request a demo on our website.