White Claw has hit the sweet spot.

As anyone familiar with college students can tell you, White Claw and other “hard seltzer” products won over younger beer drinkers to claw in a massive slice of the malted beverage market. Launched in 2016, the 1DO-calorie, two-carbohydrate, 5% alcohol by volume cans account for more than half of all spiked seltzer sales in the U.S., according to Nielsen. It’s the leader of a category that’s white hot – pre-pandemic, while 2019 beer sales produced lackluster growth of about 1 percent per annum, hard seltzer grew a stunning 227 percent.

Sugar consumption among generations

Driving this is younger Americans’ sweet tooth. The oldest Millennials were born in 1980 or ’81 (depending on which definition of the cohort is used). Think of them as the “Happy Meal” generation, which was launched in 1979. In addition to Happy Meals, they gobbled up all kinds of sucrose-laden food products.

The US Census Bureau tracks the total tonnage of sweeteners consumed domestically by year among the total population. As the table below shows, during the formative first 20 years of life for Millennials and Gen Z children, America’s per capita consumption of sugars and other caloric sweeteners was a stunning 25 percent higher than for the comparable first two decades after Boomers were born.

That’s over a half-pound more sugar per week!

Because younger people grew up eating and drinking much more sucrose and fructose, it’s no surprise they graduated to alcohol with a sweeter profile than beer. These two younger cohorts are also much heavier than their predecessors were at the same age. According to the CDC in 2018, the most recent year reported, 40 percent of people between the ages of 20-39 were considered obese, compared to about 28 percent in 2000. So a sweeter beverage with fewer calories and carbs than regular beer fits the bill.

Sweet Flavors are a Key Driver For White Claw Audience

Looking at social media conversations about White Claw and other hard seltzers, “having fun” and “partying” are the top types of mentions. But before turning to that topic it’s valuable to understand the sweetness angle in more detail, starting with the wide variety of flavors offered.

Simporter examined a corpus of over 100,000 posts by hard seltzer consumers on Twitter, Instagram, and e-commerce reviews in North America to see what are the perceived benefits by consumers. In other words, what motivates them to grab a 12-pack of White Claw or Truly instead of beer. Flavor is the key driver in this segment, followed by hydration and health/lower calorie benefits.

Somewhat surprising, the fact that hard seltzers are gluten-free also made the list.

Consumers talk quite a bit about the category’s flavor variety. Among the leading brands, sweet and citrusy flavors especially lemon and lime are the most popular. This is followed by the similarly sweet mango, which tends to have citrusy notes. More recently strawberry, black cherry, and pineapple have captured consumers’ enthusiasm.

Perceived Benefits Of Hard Seltzer

Notice how White Claw and several other brands offer narrow cans with a wider than usual pour mouth? That design also pays off on sweetness because it centralizes the fizzy liquid to the tip of the tongue where most sugar-receptive taste buds are located. The narrower diameter of the can cylinder also causes a faster flow onto the tongue with each gulp.

Another meaningful product characteristic paying off on sweetness and taste is that the optimum temperature for hard seltzer is about 12 degrees Fahrenheit higher than for typical beer. This is because hard seltzer is mostly water, best consumed at 55 degrees Fahrenheit, its average temperature coming out of the ground. Carbonated water should be slightly warmer than ground water so its bubbles are less aggressive and flavor profile more pronounced.

In comparison, most beers should be served from 42 to 48 degrees. So for occasions like outdoor parties and socially-distant gatherings where it’s tough to keep beverages icy cold, hard seltzers tend to be more refreshing than hoppy beer.

Consumers Engamenet With Brand In Terms Of Partying And Social Life

All those different hard seltzer flavors generate more online engagement compared to the range of beer flavor varieties. To be sure, many Millennials and legal-age Gen Z are passionate particularly about craft beer. But the sentiment exhibited in their mentions about, for instance, which IPA has the best balance of hops is not as intense as the chatter around hard seltzer flavors. The frequency of both high positive and high negative sentiment regarding hard seltzer eclipses what’s posted about beers.

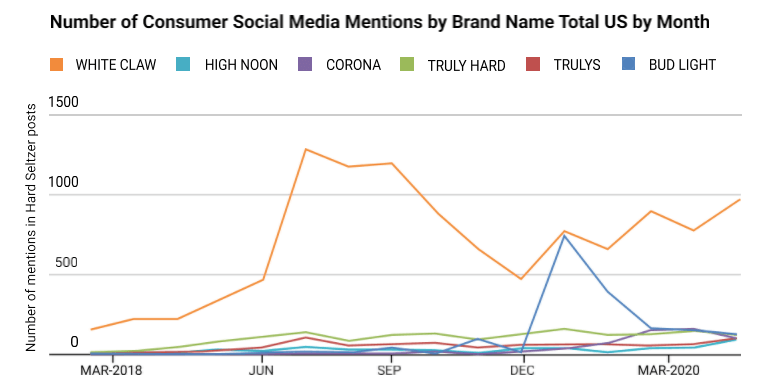

Number Of Consumer Social Media Mentions By Brand Name Total US By Month

Returning now to the primary consumer-generated type of message about hard seltzer – having fun and partying. It’s fair to assume that a hard seltzer brand with high levels of consumer engagement around fun/partying is operating from a position of strength. To examine this Simporter used natural language processing to parse consumer posts for context. We assembled a large lexicon of words and phrases that signal fun, partying, having a good time, intoxication (sorry, tuition-paying moms & dads), and so forth. Then we examined the consumer posts for volume and frequency of this partying sentiment, excluding noise from paid promoters and brand social marketing activities.

We use clues from the public social media posts to classify and segment consumers by age. So if a consumer’s post discusses the class of 1993’s reunion, they’re bucketed in with the 40+ age group.

Messages that were examined were posted from August 1, 2019 – July 31, 2020 — both before and after the pandemic began. While the volume of posts about these brands was higher before the pandemic than it was afterwards, there was no significant difference in sentiment, so we didn’t break out pre- versus post-Covid 19 findings.

Overall, White Claw enjoyed a significantly higher level of consumer engagement with the partying/fun topics among people under age 30. Organic messaging about the other brands tended to skew to different topics.

Of course, it’s the brilliant branding and clever social media campaigns that drive affinity for White Claw. Many articles have been written about how this pioneering seltzer company leveraged Instagram and other social outlets to drive interest, awareness, and cool-factor. Yet many imitators with big marketing budgets have emerged in the past year.

To see if White Claw still has an edge here post-Covid, in July 2020 we surveyed 100 consumers of hard seltzer between the ages of 21-35, asking them whether they agreed with the statement “this is a brand for people like me.” White Claw retained its leadership spot.

This affinity translates to increased interaction between consumers and the brand. This is seen in social media data, where White Claw enjoys a leading share of consumers’ messaging about hard seltzer. Among the public social media posts by consumers that mention a hard seltzer brand by name, 58 percent of them mentioned White Claw first. This figure does not include posts or mentions made by the brands themselves. As shown in the chart below, mentions of White Claw have trended up all year.

For now, independent brewer White Claw remains on top. But plenty of competition is nipping at its heels, including hard seltzer brands from AB InBev and Constellation Brands. Even the Coca Cola Company jumped into the category, launching Topo Chico Hard Seltzer in Latin America this year and expanding to the US in 2021. Nielsen data includes the segment tripled in size to $2.7 billion in 2019, and some analysts predict it will triple again by 2023. Growth, even despite the disruption of Covid? How sweet it is.