In today’s fast-paced retail environment, one area remains a critical focal point: shelf space. Both private labels and household brands are wrestling for this coveted real estate, but it’s not just a consumer-facing battle. For CPG enterprises and retailers alike, the allocation of shelf space is a strategic maneuver that can significantly impact sales and consumer loyalty.

So why is this seemingly simple area so critical? For CPG companies, the right shelf placement can be the ticket to accelerated sales and increased market share. Retailers, conversely, aim to optimize this space to meet consumer needs while maximizing profits.

What makes private labels surge ahead in some aspects, and why do renowned brands continue to dominate in others? In this article, we’re setting out to answer these key questions and offer insights on how enterprises can effectively navigate this complex landscape.

The Rise of Private Labels

Building on the foundation of why shelf space matters, it’s essential to recognize a rising star in this retail saga: private labels. Once viewed as the lesser alternatives to big-name brands, private labels have steadily climbed the ranks. What’s behind this shift? Quality and affordability, matched with increasingly savvy consumer behavior.

According to a report by the Private Label Manufacturers Association, private label market share has increased by nearly 40% over the last decade. But it’s not just about numbers. Consumer perception has evolved. Private labels are no longer seen as the ‘generic’ option but are viewed as brands in their own right. Retailers have invested in quality control, product design, and marketing to elevate the status of their in-house products. From organic food lines to high-quality home essentials, the private label sector is showing its ability to adapt and thrive in various categories.

In essence, private labels have successfully tapped into a consumer desire for value without compromising on quality. This evolution benefits retailers, but poses a set of new challenges for CPG companies wedded to established brands. As private labels continue to gain traction, the need for actionable insights and strategic positioning has never been greater for CPG enterprises.

Brands Still Matter: Why?

As we pivot from the ascending trajectory of private labels, let’s not overlook the enduring power of well-known brands. Yes, private labels are gaining ground, but established brands remain formidable players for specific reasons: brand loyalty, consumer trust, and perceived quality.

Firstly, brand loyalty isn’t built overnight. For many consumers, well-known brands offer a sense of comfort and reliability that has been honed through years or even generations. The emotional connection to a brand often transcends price considerations, making consumers more likely to stick with what they know and love.

Secondly, trust plays a pivotal role. When consumers spot a recognizable logo or packaging, there’s an inherent assumption of quality and safety. This trust has often been cultivated through years of positive experiences, high-quality advertising, and even endorsements. Brands that have earned consumer trust have a natural advantage when it comes to shelf space, as retailers want to stock products that will undoubtedly move.

Lastly, there’s the perception of quality. Many consumers equate the longevity and reputational strength of a brand with superior quality. This perception isn’t merely psychological; it often stems from real differentiators like ingredient quality, customer service, or product durability.

In summary, while private labels have made significant inroads, traditional brands still wield a unique set of advantages that resonate deeply with consumers. For CPG enterprises seeking to counteract the rise of private labels, leveraging these innate strengths is crucial.

Key Differentiators: Private Labels vs. Brands

Having shed light on why both private labels and established brands retain their unique appeal, let’s now turn the spotlight on what sets them apart. These distinctions don’t merely boil down to a logo or a price tag; they’re multifaceted, affecting everything from pricing to consumer perceptions.

Pricing:

Private labels typically offer a more budget-friendly price point. The absence of significant marketing overhead and streamlined supply chains contribute to this cost-effectiveness. Brands, however, often price higher, attributing the cost to superior quality or unique features. Price sensitivity is a real factor in consumer choice, and CPGs must assess whether the higher pricing of branded goods delivers commensurate value in the eyes of the consumer.

Quality:

The notion that private labels are inherently lower in quality is increasingly outdated. Retailers have invested in quality control to a point where many consumers see little to no difference between brands and their private-label counterparts. Yet, established brands often do have a leg up in terms of innovation and specialized features, backed by years of R&D investments.

Packaging:

Brands typically invest more in packaging design as part of their overall branding strategy. The aesthetic appeal can make a significant difference in grabbing consumer attention. Private labels, though improving, usually have more straightforward designs. Packaging is often the first point of engagement, and its impact should not be underestimated.

Marketing Strategies:

This area is where big brands often go all out. Celebrity endorsements, extensive advertising campaigns, and social media buzz are integral parts of a well-oiled marketing machine. Private labels may not have the budget for such extravagance, but they have the advantage of in-store promotion. Both routes have their merits, but marketing reach can substantially tip the scales in favor of brands.

Consumer Perceptions:

As we’ve mentioned, consumer perceptions of private labels have improved, but the heritage and storytelling around established brands still carry significant weight. The ‘brand story’ is an often-overlooked aspect that can resonate deeply with consumers, creating another layer of differentiation.

By understanding these differentiators, CPG companies can develop strategies that capitalize on the unique strengths of both private labels and brands. In this increasingly complex retail landscape, knowing these key differences isn’t just an advantage; it’s a necessity.

The Metrics of Shelf Space

Now that we’ve delved into the characteristics that set private labels and brands apart, let’s pivot to the retailer’s perspective. How do they decide who gets the prime real estate on their shelves? Believe it or not, it’s not just about who offers the highest profit margins. Retailers analyze a spectrum of metrics to make informed decisions on shelf space allocation.

Sales Velocity:

This measures the rate at which a product sells over a specific time frame. Products with higher sales velocities often get prime spots because they’re more likely to move fast. This metric is a win-win, benefiting both consumers and retailers.

Gross Margin:

Yes, profitability matters. Retailers examine the gross margin percentages to decide which products offer the best return on shelf space investment. Brands with higher margins have an advantage here, but they can’t rest easy; the value proposition must justify the price.

Consumer Behavior Analysis:

Advanced data analytics are now used to track shopper behaviors—what they pick up, what they put back, even how long they spend looking at an item. Understanding consumer behavior through data analytics offers an invaluable lens for effective shelf space utilization.

Inventory Turnover:

Retailers also consider how quickly they can restock items. Brands that offer streamlined supply chain solutions can score points in this arena.

The use of data analytics doesn’t stop at understanding past behaviors. Predictive analytics tools, like those offered by Simporter, allow for forecasting trends and sales, thus enabling retailers and CPG enterprises to strategize proactively rather than reactively. Data-driven decisions are making the allocation of shelf space more scientific and less of a guessing game.

How Simporter Can Help

As we’ve navigated the complex landscape of private labels and branded products, it’s evident that the battleground for shelf space is data-driven and dynamic. So how can CPG companies and retailers take control of this intricate equation? Enter Simporter, a solution equipped with advanced features to help navigate these complexities with data-driven insights.

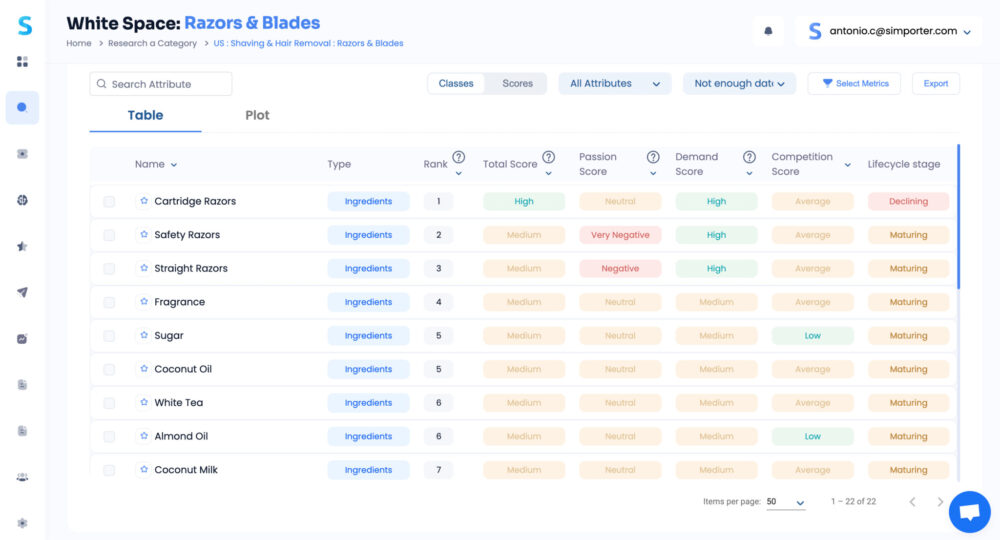

Feature 1: Predicting Product Trends

Understanding consumer behavior is just the tip of the iceberg. Simporter takes it a notch higher by predicting product trends, like ingredients, sensory attributes, and need states. This is done by capturing data from multiple sources such as Instagram mentions and eCommerce reviews. Staying ahead of the trend curve is no longer aspirational; it’s achievable.

Feature 2: Concept Development

Beyond understanding trends, how do you apply this knowledge? Simporter allows for the combination of various attributes to develop unique product concepts. With a total score that ranks top concepts, you can streamline the development phase, ensuring you’re focusing on genuinely promising ideas.

Feature 3: GPT Generated Concepts

Still facing a creative block? Simporter employs GPT technology to automatically generate product descriptions and concepts, making innovation more accessible than ever. It literally brings your highest-performing concepts to life, without the traditional brainstorming hurdles.

Feature 4: Concept Testing

All concepts are not created equal. Simporter allows you to test these concepts within the same tool. No more juggling between platforms; you can validate your ideas swiftly and effectively.

Feature 5: Sales Forecasting

Wouldn’t it be great to know the future? Simporter offers sales and incremental sales forecasting before you even launch a new product. These predictive analytics make your market entry more of a calculated move than a shot in the dark.

By harnessing the power of Simporter, companies can gain a comprehensive, data-driven approach to master the intricacies of shelf space competition and consumer preference. It’s not just about surviving this fierce competition anymore; it’s about thriving in it.

Conclusion

We’ve traversed the complex battleground of private labels and branded products vying for the precious real estate of grocery store shelves. We’ve seen that the contest is fierce but not insurmountable. Both traditional brands and emerging private labels have their unique strengths, and retailers are using increasingly sophisticated metrics to balance their offerings. The challenges are intricate, but the opportunities for differentiation and profitability are significant.

In this volatile landscape, the power of data analytics and predictive tools cannot be overstated. Simporter stands out as an invaluable ally in this setting, enabling companies to anticipate trends, craft compelling concepts, test these ideas, and even forecast sales. It essentially converts your strategy from a guessing game into a data-driven, calculated approach.

So as the dynamics of retail continue to evolve, the tools to navigate them are more advanced than ever. Are you equipped to win the battle for shelf space?