Like most things, the pandemic changed the way we approach haircare. Being stuck at home enabled us to enter a more natural era where the “art” of air drying took over and our hair healed with less heat applied. With kids at home, pests like lice were on the decline and overall, we became more curious about what ingredients are inside our shampoos.

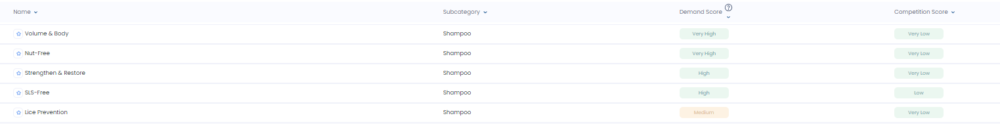

With all of the shifting behaviours post-pandemic consumer needs have changed as well. We wanted to discover what exactly is the new scope of consumer trends within the shampoo market, and we took to our AI whitespace tool to dig into it.

Using Simporter AI we identified the gaps in the market by filtering data from social media, e-commerce product reviews, and search queries. The Simporter tool summarizes findings in a simple-to-digest dashboard that helps you understand the growing trends in terms of consumer demand and competition.

1. Volume and Body

When it comes to stylish haircuts, the hottest trends came from the eras known for the voluminous locks: the 70s and the 80s. Feathered curtain bags and layered fringed mullets were the most popular looks, and to nail these cuts it was vital to have voluminous hair. Accordingly, consumers are looking for their shampoo to help them achieve that.

Considering a consumer-centric brand Hims & Hers, they’ve recently hit this trend with their latest product release focused on volume and body. Their new Max Volume Shampoo is now on the market for both men and women, and it focuses on separating strands and lifting hair at the roots to give users exactly what the name claims – Max Volume.

2. Nut-Free

The popular movement towards more natural ingredients made its way to the haircare market as well and has led to the rise in the use of natural oils. While natural oils are great for some people, consumers who have nut allergies or sensitivities need to be careful when choosing their next haircare product. Things like coconut extract and other tree nut oils can cause irritation for many. This is why we’re seeing a growing demand for nut-free shampoos.

Even big companies such as The Body Shop release nut-free shampoo products on the market. Their Banana Shampoo uses real banana puree from Ecuador, rather than tree nuts. Along with them, popular haircare brand Dry Bar released Sake Bomb Shampoo which is nut free.

If you want to nail this trend, make sure it’s evident on your packaging it is a nut-free shampoo so consumers can be 100% certain that their scalps will be safe from irritation.

3. Strengthen and Restore

Among consumers, we’re seeing an interest spike in restoring and strengthening the hair. This can be linked to the trend of moving to more natural hair styling. Rather than spending money on damaging hair services such as bleaching and perming, that for most people lead to split ends, tangles, frizz, breakage, hair loss, and dull and rough hair, consumers are looking to revitalise their hair for thicker regrowth and natural shine.

Scalp care has become a big topic of discussion when it comes to strengthening and restoring, and consumers are looking for shampoos that will nourish their hair follicles rather than block them.

4. SLS-Free

If there’s one thing happening across the consumer goods market, it’s the fact that now, more than ever, consumers read the declarations and educate themselves on the effects of each ingredient. SLS, or sulfates, are often negatively questioned by many consumers. While SLS helps remove silicones from your hair, it does so by stripping down the good oils, leaving hair feeling dry and scalps flakey.

This negative effect has increased the demand for SLS Free Shampoos. Simply put, consumers are looking for gentler cleansers that don’t leave the feeling of itching and dry scalp.

A range of SLS Free Shampoos are already hitting the market. Green People, a brand from the UK has a complete product line of SLS Free Shampoos, while larger brands like Dove and Aveeno have also launched their own SLS Free Shampoos.

5. Lice Prevention

Kids are back at school and adults are back in the office, so it’s not a surprise that lice and pests that thrive on social interaction are back with a vengeance. We’ve seen an uptick in demand for lice-prevention shampoos and consumers are more than ever looking for shampoos that work.

Having head lice is irritating, to say the least, so getting a shampoo that is proven to work is a key thing for consumers looking to deal with pests. Having clinically tested ingredients like Permethrin is key for winning over consumers. Pharmahealth’s De-Lice Shampoo does a great job of making clear their shampoo not only has Permethrin but will also kill lice and eliminate itchiness.

Conclusion

All in all, shampoo trends are following the larger umbrella trends in the consumer goods space. That means consumers are more than ever interested in natural products and approaches to taking care of their hair. With customers curious about what’s in their shampoo bottles and what each ingredient means, it’s becoming increasingly important for companies to rid products of anything harmful, and clearly state anything that could be irritating. In addition, as we continue to navigate the post-COVID world, pesky things like lice will become a reality again and consumers will want proven products that can help them stop these little “invaders” as soon as possible.

The AI Whitespace tool is just the start of what we can help you with when it comes to an understanding of how the consumer market is developing. If you want to dig deeper into the top consumer needs for shampoo, head over to our website to request a demo.